Review and recommend to our Board any equity compensation program involving the use of our company’s securities, including stock options and restricted stock;

When appropriate, select, retain and terminate independent compensation consultants to advise the committee;

Administer the compensation for our Chief Executive Officer and other executive officers and ensure consistency with our company’s executive compensation policy;

Advise and assist our company in defining its total compensation policy;

Review and comment on the compensation program to ensure that it supports our company’s strategic and financial plans;

Review and recommend to our Board for approval new incentive plans that are consistent with the total compensation policy, and monitor the appropriateness of payouts;

Review retirement plans to ensure they are meeting company objectives and are in compliance with relevant regulations;

Review the establishment, amendment and termination of employee benefits plans, including equity plans, and oversee the operation and administration of such plans;

Review our company’s compensation policies for regulatory and tax compliance, including structuring compensation programs to preserve tax deductibility and, as required, establishing performance goals and certifying that performance goals have been attained for purposes of Section 162(m) of the Internal Revenue Code (the “Code”);

Include a report on executive compensation in our company’s proxy statement as required by Securities and Exchange Commission rules;

Review annually our company’s risk assessment to determine whether compensation policies and practices are reasonably likely to have a material adverse effect on our company;

Review and discuss with management the Compensation Discussion and Analysis required by Securities and Exchange Commission Regulation S-K, Item 402, and determine whether to recommend to our Board that the Compensation Discussion and Analysis be included in our company’s annual proxy statement for the annual meeting of shareholders;

Annually review its charter and make recommendations for changes to our Board; and

Fulfill such other duties and responsibilities as may be assigned to the committee by our Board or Chairman of the Board.

| ■ | Review and recommend to our Board any equity compensation program involving the use of our company’s securities, including stock options, restricted stock awards and restricted stock units; |

| ■ | When appropriate, select, retain and terminate independent compensation consultants to advise the committee; |

| ■ | Ensure that the compensation for our Chief Executive Officer and other executive officers is consistent with our company’s executive compensation policy; |

| ■ | Advise and assist our company in defining its total compensation policy; |

| ■ | Review and comment on the compensation program to ensure that it supports our company’s strategic and financial plans; |

| ■ | Review and recommend to our Board for approval new incentive plans that are consistent with the total compensation policy, and monitor the appropriateness of payouts; |

| ■ | Review retirement plans to ensure they are meeting company objectives and are in compliance with relevant regulations; |

| ■ | Review the establishment, amendment and termination of employee benefits plans, including equity plans, and oversee the operation and administration of such plans; |

| ■ | Review our company’s compensation policies for regulatory and tax compliance, including structuring compensation programs to preserve tax deductibility and, as required, establishing performance goals and certifying that performance goals have been attained for purposes of Section 162(m) of the Internal Revenue Code (the “Code”); |

| ■ | Include a report on executive compensation in our company’s proxy statement as required by Securities and Exchange Commission rules; |

| ■ | Review annually our company’s risk assessment to determine whether compensation policies and practices are reasonably likely to have a material adverse effect on our company; |

| ■ | Review and discuss with management the “Compensation Discussion and Analysis” required by Securities and Exchange Commission Regulation S-K, Item 402, and determine whether to recommend to our Board that the “Compensation Discussion and Analysis” be included in our company’s annual proxy statement for the annual meeting of shareholders; and |

| ■ | Fulfill such other duties and responsibilities as may be assigned to the committee by our Board or Chairman of the Board. |

In fulfilling its duties and responsibilities, the committeeCompensation Committee may hire independent consultants, confer with our internal human resource professionals and consult with our Chief Executive Officer and other members of management. In each of the last four fiscal years, 2013 and 2014, the committee engaged Towers Watson (n/k/a Willis Towers Watson), an independent compensation consultant that has no other ties to our company or its management, to review compensation philosophy, competitiveness, pay for performance, and short term and long term incentive compensation design. The committee believes that Willis Towers Watson is independent of our management. Our management has not engaged Willis Towers Watson to provide any other services to our company.

During the committeeCompensation Committee meetings held in fiscal year 2014,2017, certain members of management were present to address specific topics within the scope of their responsibilities. In addition, Messrs.Mr. Anderson, our former Chief Executive Officer, Ms. Gugino, our Chief Financial Officer, and ArmstrongMr. Korsh, our Vice President, General Counsel and Secretary, attended several of the meetings to provide certain recommendations to the committee regarding the compensation of other executive officers and to discuss the financial implications of various compensatory awards and benefit programs. Messrs.Mr. Anderson, Ms. Gugino and ArmstrongMr. Korsh were not present during the committee’s discussion and determination of their respective compensation.

Compensation Committee Interlocks and Insider Participation. The members of our Compensation Committee are identified by name in the “Compensation” column of the chart that appears above within the subsection captioned “Committee Overview.” None of the members of the committee was an officer or employee of Patterson Companies, Inc. during fiscal year 20142017 or in any prior year, and none of the members of the committee had any relationship requiring disclosure under Item 404 of Regulation S-K. There were no Compensation Committee interlocks as described in Item 407(e)(4) of Regulation S-K.

Compensation Committee Report. Our Compensation Committee has reviewed and discussed the “Compensation Discussion and Analysis” that appears herein with management. Based on such review and discussions, the committee recommended to our Board that the “Compensation Discussion and Analysis” be included in this proxy statement and, thereby, in our Annual Report on Form 10-K for the fiscal year ended April 26, 2014.29, 2017.

Respectfully submitted,

/s/ Ellen A. Rudnick, Chairman

/s/ Andre B. Lacy

| Respectfully submitted, /s/ Ellen A. Rudnick, Chairman

/s/ Sarena S. Lin /s/ Neil A. Schrimsher /s/ Les C. Vinney

The Compensation Committee |

Our Governance and Nominating Committee and Its Procedures for Nominations

Responsibilities and Composition. Our Governance and Nominating Committee, chaired by Andre B. Lacy until March 2014 and since by John D. Buck, as Lead Director, performs the core function of providing the overall protocol for Board operation. It also serves as the nominating committee, making recommendations as to nominees to serve as members of our Board and regarding the composition of the committees of our Board. The committee’s responsibilities include establishing criteria for Board and committee membership, considering rotation of committee members, reviewing candidates’ qualifications and any potential conflicts with our interests, assessing the contributions of current directors in connection with their re-nomination, and making recommendations to the full Board on how to improve the effectiveness of our Board. The committee believes that diversity of viewpoints, backgrounds, skills, experience and expertise is a key attribute for directors. As a result, the committee seeks to have a diverse Board that is representative of our company’s customer, employee and shareholder base. The committee carefully considers diversity when considering nominees for director and periodically reviews its recruitment and selection protocols to ensure that diversity remains a component of each director search.

The committeeOur Governance and Nominating Committee has identified nominees based upon suggestions by non-management directors, executive officers, shareholders and third-party search firms. Our director selection criteria includes: integrity; high level of education; business experience; broad-based business acumen; understanding of our business and industry; strategic thinking and willingness to share ideas; network of contacts; and diversity of experiences, expertise and backgrounds among members. The committee has used these criteria to evaluate potential nominees. The committee does not evaluate proposed nominees differently depending upon who has made the recommendation.

In prior years, the committeeOur Governance and Nominating Committee has from time to time engaged third-party search firms to provide assistance in the identification and evaluation of potential nominees, whose qualifications and independence are then thoroughly evaluated by the committee. The committee has paid fees to third-party search firms for such assistance, including most recently the identification and evaluation of Sarena S. Lin and Neil A. Schrimsher, both of whomAlex N. Blanco, who joined our Board in March 2014.April 2017.

It is the committee’sour Governance and Nominating Committee’s policy to consider director candidates recommended by shareholders who appear to be qualified to serve on our Board. The committee may choose not to consider an unsolicited recommendation if no vacancy exists on our Board and the committee does not perceive a need to increase the size of our Board. The committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Nomination Procedures. To submit a recommendation of a director candidate to our Governance and Nominating Committee, a shareholder must submit the following information in writing, addressed to our Lead Director,Chairman of the Board, care of our Corporate Secretary, at the main office of Patterson Companies, Inc.:

| (1)■ | The name of the person recommended as a director candidate; |

| (2)■ | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Exchange Act Regulation 14A; |

| (3)■ | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| (4)■ | As to the shareholder making the recommendation, the name and address, as they appear on the books of Patterson Companies, Inc., of such shareholder; provided, however, that if the shareholder is not a registered holder of common stock, the shareholder must submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of our common stock; and |

| (5)■ | A statement disclosing whether such shareholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

Our Bylaws provide that in order for a person nominated by a shareholder to be eligible for election as a director at any regular or special meeting of shareholders, a written request that his or her name be placed in nomination must be received from a shareholder of record by our Corporate Secretary not less than 90 days prior to the date fixed for the meeting, together with the written consent of such person to serve as a director. A copy of our Bylaws may be obtained by written request to Patterson Companies, Inc., 1031 Mendota Heights Road, St. Paul, Minnesota 55120, Attn: Jonelle R. Burnham.Les B. Korsh, Vice President, General Counsel and Secretary.

Minimum Qualifications. In carrying out its responsibility to find the best-qualified persons to serve as directors, our Governance and Nominating Committee will consider appropriate data with respect to each suggested candidate, consisting of business experience, educational background, current directorships, involvement in legal proceedings during the last ten years which are material to the evaluation of the integrity of the candidate, and an indication of the willingness of the candidate to serve as a director.

In addition, prior to nominating an existing director for re-election to our Board, the committeeour Governance and Nominating Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to our Board; and his or her independence. Pursuant to ourthe Corporate Governance Guidelines we originally adopted during fiscal year 2013, independent directors generally may not stand for election following their attaining the age of 75, or 20 years of service as a director on our company’s Board.

The committeeOur Governance and Nominating Committee is also responsible for overseeing and reviewing our processes for providing information to our Board. The committee completes an annual review of the performance of our Chief Executive Officer. In addition, the committee recommends a succession plan to our Board for our Chief Executive Officer and reviews programs created and maintained by management for the development and succession of other executive officers and other individuals identified by management or the committee. Our Governance and Nominating CommitteeThe committee also sets director compensation. Our Governance and Nominating CommitteeThe committee held four meetings during fiscal year 2014.2017.

Our Finance and Corporate Development Committee

Purpose.The purpose of our Finance and Corporate Development Committee, established in June 2015, is to oversee our company’s capital structure, capital budget and capital expenditures, issuance and repurchase of equity and debt, and acquisitions and divestitures, and corporate investment and treasury policy and their consistency with our company’s overall financial and strategic plans.

Responsibilities and Organization. Our Finance and Corporate Development Committee, chaired by Neil A. Schrimsher, has the following specific responsibilities:

| ■ | Review and make recommendations to our Board regarding our company’s capital structure and all issuances, sales or repurchases of equity or long-term debt; |

| ■ | Review and recommend to our Board the annual operating plan, including the financing plan (including dividend policy and uses of cash) and the capital budget for each fiscal year, and approve or recommend to our Board, as appropriate, capital expenditures in excess of amounts to be determined by the committee; |

| ■ | Approve or review and recommend to our Board, as appropriate, acquisitions, divestitures, partnerships and combinations of business interests (“principal portfolio transactions”) valued in excess of amounts to be determined by the committee; |

| ■ | Review at least annually the results and effectiveness of significant recent capital expenditures and principal portfolio transactions; |

| ■ | Review our company’s treasury policy as it relates to management of customer credit, commodity risks, exposures relating to insurance and risk management programs, and other financial risks that our Board may delegate to the committee for review; and |

| ■ | Review our company’s principal investment policies, procedures and controls with respect to investments and derivatives, foreign exchange and hedging transactions. |

Our Finance and Corporate Development Committee reports to our Board on the principal matters reviewed or approved at each meeting and provides recommendations as to actions to be taken by our Board. The committee has the sole authority to retain and terminate any outside financial or other consultants to assist in carrying out its duties, including the authority to approve consultant fees and other retention terms. The committee has the authority to obtain advice and assistance from internal or external legal, financial or other advisors. In addition, the committee has the authority to delegate any of its responsibilities to subcommittees, as it deems appropriate, subject to the requirements of applicable laws and regulations. The committee held four meetings during fiscal 2017.

Our Search Committee

Our Search Committee was formed upon Mr. Anderson’s resignation as President and Chief Executive Officer in June 2017 in order to begin the process of hiring a permanent President and Chief Executive Officer. This committee’s functions include identifying and evaluating potential candidates, and ultimately advising the Board on its recommendations for hiring a successor President and Chief Executive Officer. This committee, which is chaired by Ellen A. Rudnick, was created subsequent to the end of fiscal 2017 and has retained Spencer Stuart to conduct a search for a permanent President and Chief Executive Officer.

Communications with Board Members

Our Board of Directors has provided the following process for interested persons to send communications to our Board or individual directors. All communications from shareholders should be addressed to Patterson Companies, Inc., 1031 Mendota Heights Road, St. Paul, Minnesota 55120, Attention: CorporateLes B. Korsh, Vice President, General Counsel and Secretary.

Communications to individual directors may also be made to such director at our company’s address. All communications sent to the chair of our Audit Committee or to any individual director will be received directly by such individuals and will not be screened or reviewed by any company personnel. Any communications sent to our Board in the care of our Corporate Secretary will be reviewed by herhim to ensure that such communications relate to the business of our company or its subsidiaries before being reviewed by our Board.

Board Member Attendance at Annual Meetings

Under our Corporate Governance Guidelines, it is our policy that all directors should be present at the annual meeting of shareholders. We generally hold a Board of Directors meeting coincident with the shareholders’ meeting to minimize director travel obligations and facilitate their attendance at the shareholders’ meeting. All directors then in office attended the 20132016 annual meeting of shareholders.

NON-EMPLOYEE DIRECTOR COMPENSATION

Non-employee directors receive cash compensation and equity-based compensation for their service on our Board of Directors. DuringAfter performing a peer group review and substantive analysis in fiscal year 2014,2016, we altered the compensation structure for our non-employee directors. For fiscal 2017, a 3% increase to the overall compensation for non-employee directors receivedwas approved, with all of such increase to be paid as equity and not as a cash retainer. As such, for fiscal 2017, non-employee director compensation included an overall retainer of $206,000, with $90,000 representing an annual cash retainer and $116,000 issued in the form of $62,000.restricted stock awards vesting one year from date of grant. Committee Member and Committee Chair cash retainers were as follows: $10,000 for each Member of the Audit Committee members received anand $20,000 for the Chair of the Audit Committee; $5,000 for each Member of the Compensation Committee and $15,000 for the Chair of the Compensation Committee; no additional annualcash retainer for each Member of $4,000 duringthe Governance and Nominating Committee but a $10,000 cash retainer for the Chair of the Governance and Nominating Committee; and $5,000 for each Member of the Finance and Corporate Development Committee and $15,000 for the Chair of the Finance and Corporate Development Committee. The cash retainer for the former Lead Director was $30,000; however, such retainer was replaced with a $100,000 cash retainer for the non-executive Chairman of the Board in June 2017. In addition, although our Search Committee was created subsequent to the end of fiscal year 2014. During fiscal year 2014, we also paid an additional annual2017, each Member of the Search Committee will receive a fixed cash retainer of $10,000 and the Chair of the Search Committee will receive a fixed cash retainer of $15,000, payable upon conclusion of the search for a successor President and Chief Executive Officer. Non-employee directors may elect to the chairpersonreceive shares of each committeecommon stock in lieu of our Board, and, as of September, increased the annual retainer for our Lead Director to $25,000.their director fees otherwise payable in cash. Directors are also reimbursed for all reasonable out-of-pocket expenses incurred in connection with their service on our Board.

Non-employee directors also receive stock option awards andThe value of the above-referenced restricted stock awards is reviewed annually. Under our 2015 Omnibus Incentive Plan, such annual restricted stock awards vest in full on the first anniversary of the date of grant. Non-employee directors who have a term expiring not more than 29 days prior to the natural vesting date of their restricted stock award, are deemed to remain in service as a non-employee director until such natural vesting date, but only for purposes of satisfying the vesting restrictions. Otherwise, unvested restricted stock awards are forfeited on the effective date of termination of service as a director.

Prior to fiscal 2016, restricted stock awards granted to non-employee directors under our Amended and Restated Equity Incentive Plan. Upon election to our Board, whether elected by our shareholders or by our Board to fill a vacancy, a non-employee director receives a stock option award for 12,000 shares. Thereafter, on the date of the annual meeting of shareholders, each reelected or continuing non-employee director receives a restricted stock award. However, in general, if a non-employee director has received an initial stock option award within six months of an annual restricted stock award, such initial stock option award is in lieu of that year’s annual restricted stock award. For fiscal year 2014, each such restricted stock award was for a number of shares approximately equal in value to $100,000. The value of such restricted stock awards is reviewed annually. For fiscal year 2015, each reelected or continuing non-employee director will continue to receive a restricted stock award for a number of shares approximately equal in value to $103,000. Initial stock option awards and annual restricted stock awards vestPlan vested to the extent of one-third everyper year, commencing upon the first anniversary of the date of grant. All stock options expire upon the earlier of ten years from the date of award or one year from the date of termination of service as a director. Unvested restricted stock awards granted under such plan are forfeited on the 30th30th day after termination of service as a director.

Because Mr. Anderson served as a director and an employee of our company during fiscal year 2014,2017, information regarding his compensation is set forth within the section captioned “Executive Compensation.” Because Mr. Wiltz did not begin serving as Interim President and Chief Executive Officer until June 2017, information regarding his compensation is set forth below under the caption “Compensation of Directors.”

Compensation of Directors

The following table sets forth the compensation of our non-employee directors for fiscal year 2014:2017:

| Name | | Fees

Earned

or

Paid in

Cash

($) | | | Stock

Awards

($)(c) | | | Option

Awards

($)(d) | | | Non-Equity

Incentive Plan

Compensation

($) | | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($) | | | All Other

Compensation

($) | | | Total

($) | | Fees Earned or Paid in Cash ($) | Stock Awards ($)(c) | Option Awards ($)(d) | Non-Equity Incentive Plan Compensation

($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

John D. Buck | | | 79,125 | | | | 100,006 | | | | — | | | | — | | | | — | | | | — | | | | 179,131 | | 140,000 | 116,007 | - | - | 256,007 |

| Alex N. Blanco(a) | | - | - | - | - |

Jody H. Feragen | | | 66,000 | | | | 100,006 | | | | — | | | | — | | | | — | | | | — | | | | 166,006 | | 120,000 | 116,007 | - | 236,007 |

Peter L. Frechette(a) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | |

Andre B. Lacy(b) | | | 80,125 | | | | 100,006 | | | | — | | | | — | | | | — | | | | — | | | | 180,131 | | |

Sarena S. Lin | | | 7,750 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7,750 | | 100,000 | 116,007 | - | 216,007 |

Charles Reich(a) | | | 18,833 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 18,833 | | |

Ellen A. Rudnick | | | 69,500 | | | | 100,006 | | | | — | | | | — | | | | — | | | | — | | | | 169,506 | | 115,000 | 116,007 | - | 231,007 |

Neil A. Schrimsher | | | 7,750 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7,750 | | 100,000 | 116,007 | - | 216,007 |

Harold C. Slavkin | | | 66,000 | | | | 100,006 | | | | — | | | | — | | | | — | | | | — | | | | 166,006 | | |

Les C. Vinney | | | 62,000 | | | | 100,006 | | | | — | | | | — | | | | — | | | | — | | | | 162,006 | | 115,000 | 116,007 | - | 231,007 |

James W. Wiltz | | | 62,000 | | | | 100,006 | | | | — | | | | — | | | | — | | | | — | | | | 162,006 | | |

| James W. Wiltz(b) | | 90,000 | 116,007 | - | 206,007 |

| (a) | Messrs. Frechette and Reich decidedBecause Mr. Blanco began serving on our board of Directors on the first day of fiscal year 2018, he did not to stand for re-election at our 2013 Annual Meeting.receive compensation during fiscal year 2017. |

| (b) | Having become our Interim President and Chief Executive Officer in June 2017, Mr. Lacy does not intendWiltz currently receives (1) a monthly base salary of $80,000, (2) eligibility to standparticipate in employee benefit plans, subject to plan terms, and (3) eligibility for re-electiona discretionary bonus in cash or equity at our 2014 Annual Meeting.the end of his interim service. |

| (c) | Represents the aggregate grant date fair value of the 2,4842,534 shares of restricted stock awarded to each non-employee director on September 9, 2013,12, 2016, the date of our 2016 annual meeting of shareholders, computed in accordance with FASB ASC Topic 718. Information on the assumptions used to calculate the value of awards is set forth in Note 1514 to the consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended April 26, 2014.29, 2017. The aggregate number of unvested shares of restricted stock outstanding at fiscal year-end 2017 held by our non-employee directors was as follows: |

The aggregate number of unvested shares of restricted stock outstanding at fiscal year-end 2014 held by those who served as non-employee directors during fiscal year 2014 was as follows:

| Name | | | | |

Name

| | Number of Shares

of Restricted Stock | |

John D. Buck | | | 5,416 | 3,374 |

Alex N. Blanco | - |

| Jody H. Feragen | | | 4,434 | 3,374 |

Peter L. Frechette

| | | — | |

Andre B. Lacy

| | | 5,416 | |

Sarena S. Lin | | | — | 3,374 |

Charles Reich

| | | — | |

Ellen A. Rudnick | | | 5,416 | 3,374 |

Neil A. Schrimsher | | | — | 3,374 |

Harold C. Slavkin

| | | 5,416 | |

Les C. Vinney | | | 5,416 | 3,374 |

James W. Wiltz | | | 5,416 | 3,374 |

Total | | | 36,930 | 23,618 |

| (d) | The aggregate number of unexercised stock options outstanding at fiscal year-end 20142017 held by those who served asour non-employee directors during fiscal year 2014 was as follows: |

| Name | | | | |

Name

| | Number of Stock

Options | |

John D. Buck | | | 7,500 | - |

Alex N. Blanco | - |

| Jody H. Feragen | | | 12,000 | |

Peter L. Frechette

Sarena S. Lin | | | — | 9,000 |

Andre B. Lacy

| | | 31,866 | |

Sarena S. Lin

| | | 12,000 | |

Charles Reich

| | | — | |

Ellen A. Rudnick | | | 29,000 | - |

Neil A. Schrimsher | | | 12,000 | |

Harold C. Slavkin

| | | 12,384 | |

Les C. Vinney | | | — | - |

James W. Wiltz | | | — | - |

Total | | | 116,750 | 33,000 |

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our common stock as of July 11, 2014,21, 2017, unless otherwise noted, by (a) each person who is known to us to own beneficially more than 5% of our common stock, (b) each director and nominee for director, (c) each executive officer named in the Summary Compensation Table below, and (d) the current directors and executive officers as a group. The table lists voting securities, including restricted stock held by our directors and executive officers over which they have sole voting power but no investment power. Otherwise, except to the extent noted below, each person identified below has sole voting and investment power over the shares reported. Except as otherwise noted below, we know of no agreements among our shareholders which relate to voting or investment power with respect to our common stock and none of the stated shares has been pledged as security.

| Name and Address of Beneficial Owner(a) | | Amount and Nature of Beneficial Ownership(a) | | Percent of Class(b) |

Delaware Charter Guarantee & Trust Company dba Principal Trust Company | | 13,202,739 | (c) | | 13.8% |

| The Vanguard Group | | 7,990,047 | (d) | | 8.3% |

| Parnassus Investments | | 7,914,917 | (e) | | 8.3% |

| BlackRock, Inc. | | 6,724,341 | (f) | | 7.0% |

| Scott P. Anderson | | 107,548 | (g)(h) | | * |

| Paul A. Guggenheim | | 72,475 | (g)(h) | | * |

| James W. Wiltz | | 71,300 | (i) | | * |

| John D. Buck | | 48,735 | | | * |

| Ellen A. Rudnick | | 42,235 | | | * |

| Ann B. Gugino | | 33,129 | (g)(h) | | * |

| Les C. Vinney | | 30,561 | | | * |

| Jody H. Feragen | | 25,897 | (j)(k) | | * |

| David G. Misiak | | 24,455 | (g) | | * |

| Sarena S. Lin | | 19,488 | (j) | | * |

| Neil A. Schrimsher | | 19,488 | (j) | | * |

| Les B. Korsh | | 8,786 | (g) | | * |

| John E. Adent | | 136 | (g) | | * |

| Alex N. Blanco | | - | | | - |

All current directors and executive officers as a group

(14 persons) | | 439,952 | (l) | | * |

| | | | | | | | |

Name and Address of Beneficial Owner(1) | | Amount and Nature

of Beneficial

Ownership(1) | | | Percent of

Class(2) | |

Delaware Charter Guarantee & Trust Company | | | 17,147,421 | (3) | | | 16.6 | % |

1013 Centre Road | | | | | | | | |

Wilmington, DE 19805 | | | | | | | | |

The Vanguard Group | | �� | 5,385,861 | (4) | | | 5.2 | % |

100 Vanguard Blvd. | | | | | | | | |

Malvern, PA 19355 | | | | | | | | |

Janus Capital Management LLC | | | 5,252,134 | (5) | | | 5.1 | % |

151 Detroit Street | | | | | | | | |

Denver, CO 80206 | | | | | | | | |

R. Stephen Armstrong | | | 154,577 | (6)(7) | | | * | |

Scott P. Anderson | | | 114,473 | (7) | | | * | |

James W. Wiltz | | | 133,812 | (8) | | | * | |

Andre B. Lacy | | | 128,313 | (9)(10) | | | * | |

Paul A. Guggenheim | | | 98,490 | (7) | | | * | |

George L. Henriques | | | 50,670 | (7) | | | * | |

Ellen A. Rudnick | | | 49,747 | (10) | | | * | |

John D. Buck | | | 38,747 | (10) | | | * | |

Les C. Vinney | | | 23,073 | | | | * | |

Harold C. Slavkin | | | 21,329 | (10)(11) | | | * | |

Ranell M. Hamm | | | 20,916 | (7) | | | * | |

Jody H. Feragen | | | 18,409 | (10) | | | * | |

Sarena S. Lin | | | 0 | | | | * | |

Neil A. Schrimsher | | | 0 | | | | * | |

All directors and executive officers as a group (19 persons) | | | 972,534 | (12) | | | * | |

| | |

* Represents less than 1%.

* | Represents less than 1%. |

(1)(a) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting or investment power with respect to securities. Securities “beneficially owned” by a person may include securities owned by or for, among others, the spouse, children or certain other relatives of such person as well as other securities as to which the person has or shares voting or investment power or has the option or right to acquire within 60 days. The same shares may be beneficially owned by more than one person. Includes shares of common stock held by our Employee Stock Ownership Plan and Trust (the “ESOP”).ESOP. Shares reported as owned by the ESOP trustee are also reported as beneficially owned by our executive officers to the extent that shares |

| | have been allocated to the ESOP accounts of the named persons. Allocated shares are voted by the ESOP trustee in accordance with the direction of ESOP participants. Generally, unallocated shares and allocated shares as to which no direction is made by the participants are voted by the ESOP trustee in the same percentage as the allocated shares as |

| to which directions are received by the ESOP trustee. Unless otherwise indicated, the address of each shareholder is c/o Patterson Companies, Inc., 1031 Mendota Heights Road, St. Paul, Minnesota 55120. |

(2) | (b) | Percentage of beneficial ownership is based on 103,341,63295,775,922 shares outstanding as of July 11, 2014.21, 2017. Shares issuable pursuant to options are deemed outstanding for computing the percentage of the person holding such options but are not deemed outstanding for computing the percentage of any other person. |

(3) | (c) | As set forth in Schedule 13G/A filed with the Securities and Exchange Commission by Delaware Charter Guarantee & Trust Company dba Principal Trust Company as trustee for our ESOP on February 10, 2014,2017, represents shares over which shared voting power and shared dispositive power is claimed. The ESOP is subject to the Employee Retirement Income Security Act of 1974 (“ERISA”). The reporting person acts as the trustee for our ESOP. The securities reported include all shares held of record by the trustee. The trustee follows the directions of our company, or other parties designated in the trust agreement between our company and the trustee, with respect to voting and disposition of the shares. The trustee, however, is subject to fiduciary duties under ERISA. The trustee disclaims beneficial ownership of the reported shares. As of July 11, 2014,21, 2017, the number of shares reported as beneficially owned included approximately 2,736,9702,189,144 shares held in the unallocated account of the ESOP and approximately 13,810,37510,050,959 shares held in the allocated account of the ESOP. The reporting person’s address is 1013 Centre Road, Suite 300, Wilmington, DE 19805-1265. |

(4) | (d) | As set forth in Schedule 13G13G/A filed with the Securities and Exchange Commission by The Vanguard Group (“Vanguard”) on February 12, 2014.10, 2017. The Schedule 13G13G/A reports that Vanguard is an investment adviser with sole voting power over 139,034132,120 shares, shared voting power over 17,780 shares, sole dispositive power over 5,264,2277,836,672 shares, and shared dispositive power over 121,634153,375 shares. The Schedule 13G13G/A further reports that Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of Vanguard, is the beneficial owner of 105,434106,920 shares as a result of its serving as investment manager of collective trust accounts and that Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of Vanguard, is the beneficial owner of 49,80071,655 shares as a result of its serving as investment manager of Australian investment offerings. The reporting person’s address is 100 Vanguard Blvd., Malvern, PA 19355. |

(5) | (e) | As set forth in Schedule 13G/A filed with the Securities and Exchange Commission by Janus Capital Management LLCParnassus Investments (“Janus”Parnassus”) on January 31, 2014.February 14, 2017. The Schedule 13G13G/A reports that JanusParnassus is an investment adviser with sole voting power and sole dispositive power over the reported shares. The Schedule 13G/A further reports that these securities are beneficially owned by clients of Parnassus, which include registered investment companies. The reporting person’s address is 1 Market Street, Suite 1600, San Francisco, CA 94105. |

| (f) | As set forth in Schedule 13G/A filed with the Securities and Exchange Commission by BlackRock, Inc. (“BlackRock”) on January 25, 2017. The Schedule 13G/A reports that BlackRock is a parent holding company/control person and has a direct 96.74% ownership stake in INTECHfor BlackRock (Luxembourg) S.A., BlackRock (Netherlands) B.V., BlackRock Advisors (UK) Limited, BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management North Asia Limited, BlackRock Asset Management Schweiz AG, BlackRock Capital Management, BlackRock Financial Management, Inc., BlackRock Fund Advisors, BlackRock Fund Managers Ltd., BlackRock Institutional Trust Company, N.A., BlackRock International Limited, BlackRock Investment Management (“INTECH”) and a direct 99.61% ownership stake in Perkins(Australia) Limited, BlackRock Investment Management (UK) Ltd., BlackRock Investment Management, LLC, (“Perkins”). Janus, INTECHBlackRock Japan Co Ltd., BlackRock Life Limited. The Schedule 13G/A reports that BlackRock has sole voting power over 5,895,930 shares and Perkins are registered investment advisers, each furnishing investment advice tosole dispositive power over 6,724,341 shares. The Schedule 13G/A further reports that various registered investment companies and to individual and institutional clients (collectively, the “Managed Portfolios”). As a result of Perkins’ role as an investment adviser or sub-adviser to the Managed Portfolios, Perkins may be deemed to be the beneficial owner of 4,782,134 shares held by the Managed Portfolios. However, Perkins does notpersons have the right to receive anyor the power to direct the receipt of dividends from, or proceeds from the sale of, the shares held in the Managed Portfolios and disclaims any ownership associated with such rights. As a result of INTECH’s role as an investment adviser or sub-adviser to the Managed Portfolios, INTECH may be deemed to be the beneficial owner of 470,000 shares held by the Managed Portfolios. However, INTECH does not have the right to receive any dividends from, or proceeds from the sale of, the shares held in the Managed Portfolios and disclaims any ownership associated with such rights. The Managed Portfolios have the right to receive all dividends from, and the proceeds from the sale of the reported shares, heldbut no one person’s interest in their respective accounts.the reported shares is more than 5% of the total outstanding shares. The reporting person’s address is 55 East 52nd Street, New York, NY 10055. |

(6) | Includes 59,786 shares pledged as collateral in connection with a margin brokerage account. |

(7)(g) | Includes the following shares allocated to the ESOP account of the following persons: R. Stephen Armstrong (13,237 shares); Scott P. Anderson (16,579(18,130 shares); Paul A. Guggenheim (12,874(10,655 shares); George L. Henriques (11,490Ann B. Gugino (9,139 shares); David G. Misiak (14,862 shares); Les B. Korsh (320 shares); and Ranell M. Hamm (662John E. Adent (136 shares). The ESOP trustee has the right to receive, and the power to direct the receipt of, dividends from such shares. |

(8) | (h) | Includes shares purchasable by the named person upon the exercise of options granted under our Amended and Restated Equity Incentive Plan or our 2015 Omnibus Incentive Plan: Scott P. Anderson (20,200 shares); Paul A. Guggenheim (6,600 shares); and Ann B. Gugino (7,400 shares). |

| (i) | Of the shares reported as beneficially owned, 11,7486,748 shares are held in trust for members of Mr. Wiltz’s family and 70,16512,817 shares are held in a revocable trust of which Mr. Wiltz is a trustee. |

(9) | Of the shares reported as beneficially owned, 57,900 shares are held in a revocable trust of which Mr. Lacy is the trustee and 7,800 shares are held by Mr. Lacy’s Grantor Retained Annuity Trust. |

(10)(j) | Includes shares purchasable by the named person upon the exercise of options granted under our 2001 Non-Employee Directors’ Stock Option Plan or our Amended and Restated Equity Incentive Plan: Andre B. Lacy (31,866 shares); Ellen A. Rudnick (29,000 shares); John D. Buck (7,500 shares); Harold C. Slavkin (12,384 shares); and Jody H. Feragen (12,000 shares); Sarena S. Lin (7,000 shares); and Neil A. Schrimsher (12,000 shares). |

(11) | (k) | Of the shares reported as beneficially owned, 3501,000 shares are held by Dr. Slavkin’s spouse.in a revocable trust of which Ms. Feragen is a trustee. |

(12) | (l) | Includes 82,03442,556 shares allocated to ESOP accounts, 116,75058,600 shares purchasable upon the exercise of options, and 267,59846,659 shares over which there is sole voting power but no investment power. |

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission and provide us with copies of such reports. Based solely on our review of the copies of such forms received by us, or written representations from certain reporting persons that no Forms 5 were required for those persons, we believe that, during the past fiscal year, our officers, directors and greater than 10% shareholders complied with applicable filing requirements.requirements, except that a Form 4 was filed late on behalf of Mr. Misiak reporting the sale by Mr. Misiak of 301 shares of common stock on March 2, 2017.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Philosophy

Our company is committed to a compensation philosophy that links executive compensation to the attainment of business objectives and earnings performance, over the near and longer term, which in turn will enable us to attract, retain and reward executive officers who contribute to our success. In keeping with our company’s compensation philosophy, our Compensation Committee’s goal is to provide market-competitive compensation packages that emphasize our commitment to consistent long-term profitable growth and our belief that a substantial portion of the total compensation received by our executive officers should be dependent upon the performance of the business annually and over time.

Our Compensation Committee (the “Committee”) annually evaluatesoversees and determines all components of compensation formakes decisions regarding our Chief Executive Officer and the other executive officers. The Committee considers current salary ranges, salaries and bonus potential for each position, management’s overall salary objectives, the amount of compensation to be placed at risk, the use of short-term versus long-term incentives, the use of equity awards, the alignment of executive compensation and benefit programs. The following discussion should be read in conjunction with the enhancementSummary Compensation Table, and related tables and footnote disclosures setting forth the compensation of shareholder value, the levelsfollowing named executive officers:

| Named Executive Officer | Position |

| Scott P. Anderson (a) | Former President and Chief Executive Officer of Patterson Companies |

| Ann B. Gugino | Executive Vice President, Chief Financial Officer & Treasurer of Patterson Companies |

| John E. Adent (b) | Former Chief Executive Officer of Patterson Animal Health |

| Paul A. Guggenheim (c) | Western Region President of Patterson Dental (Former Chief Executive Officer of Patterson Dental and Former Chief Innovation Officer of Patterson Companies) |

| David G. Misiak (d) | President of Patterson Dental North America |

| Les B. Korsh | Vice President, General Counsel & Secretary of Patterson Companies |

| (a) | Mr. Anderson ceased serving as our President and Chief Executive Officer on June 1, 2017. |

| (b) | Mr. Adent ceased serving as Chief Executive Officer of Patterson Animal Health on July 2, 2017. |

| (c) | Mr. Guggenheim ceased serving as Chief Executive Officer of Patterson Dental effective June 15, 2016, and ceased serving as our Chief Innovation Officer effective June 1, 2017. |

| (d) | Mr. Misiak became President of Patterson Dental North America on November 1, 2016. |

Executive Summary

During fiscal 2017, Patterson continued to move through a period of strategic investment and change, responding to the evolving needs of our customers and implementing an enterprise resource planning (“ERP”) system to modernize our technology infrastructure for future capabilities. While we have made tremendous progress on these initiatives, our fiscal 2017 financial performance did not meet our expectations. Therefore, we have taken steps to reflect this performance in our executive compensation.

Below is a summary of our fiscal 2017 financial results from continuing operations that we believe is helpful in understanding our compensation decisions and philosophy:

| ■ | Net Sales: Consolidated net sales in fiscal 2017 were $5.6 billion, an increase of 3.8% from the prior fiscal-year period. The inclusion of Animal Health International, Inc. results for approximately six additional weeks in fiscal 2017 had a 3.6% favorable impact on sales. |

| ■ | Gross Profit: Consolidated gross profit margin decreased 130 basis points from the prior year to 23.3%. The decrease in the gross profit margin rate was predominantly the result of the inclusion of sales and cost of sales from Animal Health International, Inc. in our results for a full year in fiscal 2017, as that business traditionally has lower gross margins than our historical businesses. In addition, the Animal Health segment gross margin rate declined when compared to the prior year, primarily as a result of pricing pressure from branded pharmaceutical manufacturers. |

| ■ | Operating Income: Operating income from continuing operations, a key driver of incentive compensation, was $287.9 million, or 5.1% of net sales, in fiscal 2017, compared to $347.7 million, or 6.5% of sales, in fiscal 2016. The decrease in operating income from continuing operations was driven primarily by an impairment charge based on our November 2016 decision not to extend sales exclusivity for the full Sirona portfolio of products and increased expenses related to our ERP system initiative. The decrease in operating income as a percent of sales was mainly due to these same factors. |

| ■ | Net Income and Earnings Per Share from Continuing Operations: Net income from continuing operations decreased 6.4% to $173.8 million in fiscal 2017, compared to $185.7 million in the prior year. Earnings per diluted share from continuing operations were $1.82 in fiscal 2017, compared to $1.90 in the prior year. |

The following table provides a summary of our Total Shareholder Return (“TSR”) performance over the past three years, both on an absolute basis and relative to the S&P 400 constituent companies:

Historical TSR

Measurement Period | Patterson TSR | Percentile Rank of Patterson’s TSR Relative to S&P 400 Constituents |

| 1 Year (FY17) | -0.7% | 18th percentile |

| 2 Years (FY16 – FY17) | -3.5% | 27th percentile |

| 3 Years (FY15 – FY17) | 14.9% | 37th percentile |

While we experienced many positive developments in fiscal 2017, at the end of the year the overall value of our fiscal 2017 executive compensation package was below the targeted level, reflecting our performance orientation and challenging goals.

Fiscal 2017 Direct Compensation—Value Reflecting Fiscal 2017 Performance*

* Actual annual incentives are earned amounts, based on fiscal 2017 corporate, business unit, and individual performance. Long-term incentives (“LTI”) consist of stock options, restricted stock units and performance units, and for all employeespurposes of this chart are valued based on the stock price at the end of the fiscal 2017 and other issues. The Committee also considers other available information, including other published reports, data and surveys not specifically prepared forrelative-TSR performance through the Committee, general compensation trends, market conditions, and the Committee members’ experience with other organizations. In addition, in eachend of fiscal years 20132017. As a result, the actual LTI values presented in this chart might not be paid. Furthermore, the actual LTI values presented include zero value for stock options because all stock options, including the July 1, 2015 special one-time option grant referenced in the Outstanding Equity Awards at Fiscal Year-End table below, were underwater at the end of fiscal 2017, and 2014, the Committee engaged Towers Watson, an independent compensation consultant that has no other ties to our company or its management, to review compensation competitiveness, payzero value for performance and short term andunits since relative-TSR performance was at the 20th percentile of the S&P 400 through the end of fiscal 2017.

Also, we also had prior long-term incentive compensation design. Our compensation structure isgrants that vested during fiscal 2017, including the result of the Committee’s analysis of the effectiveness and competitiveness of the composition of our compensation structure, including cash (both base salary and annual incentives), equity and deferred compensation programs, compared to trends in the market as determined by publicly available data and as informed by our compensation consultant’s review.

In each of fiscal years 2013 and 2014, our peer group consisted of 14 local, regional and national representatives in distribution, dental manufacturing, and general industries that would potentially compete for the same talent that we would seek to recruit. The names of such companies appear below:following:

| ■ | Portions of the restricted stock awarded during fiscal 2012 through 2016 vested and were released during fiscal 2017 (i.e., each award vests in 20% increments over five years). |

| ■ | |

C. H. Robinson Worldwide, Inc. | | Henry Schein, Inc. | | School Specialty, Inc. |

Dentsply International Inc. | | MSC Industrial Direct Co. Inc. | | Sirona Dental Systems, Inc. |

Donaldson Company, Inc. | | MWI Veterinary Supply, Inc. | | Thermo Fisher Scientific Inc. |

Ecolab Inc. | | Owens & Minor, Inc. | | United Stationers Inc. |

Fastenal Company | | | | W. W. Grainger, Inc.Performance units granted during fiscal 2015 had performance criteria based on Operating Income Growth and Return on Invested Capital (“ROIC”) for the performance period of fiscal years 2015 through 2017. However, the committee’s assessment of performance resulted in the decision to provide zero payout for these performance units. |

Based onCompensation Philosophy, Practices and Components

Compensation Philosophy

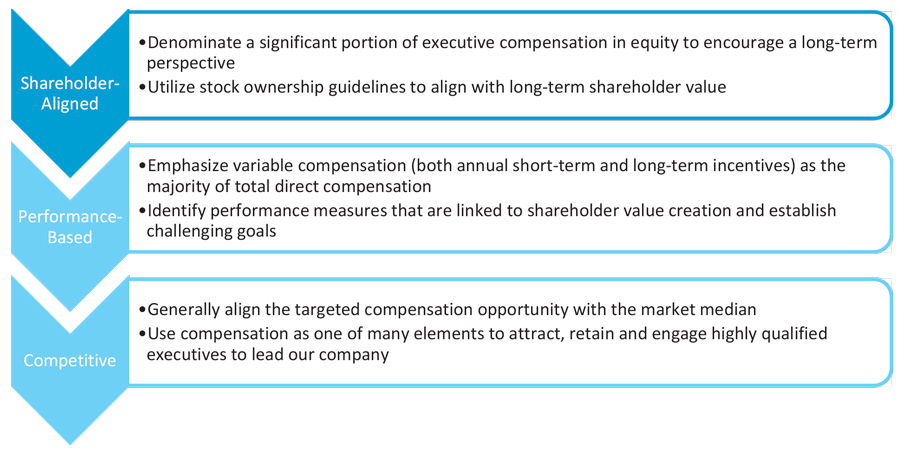

The committee is guided by the foregoing reviews,following objectives that are believed to be key to the Committee has determined that the compensationsuccessful execution of our Chief Executive Officerstrategic business imperatives, enhancing growth opportunities and the other executive officers named in the Summary Compensation Table below is consistent with our compensation philosophy, properly aligned with performance as comparedproviding benefits to our peer group, market-competitive, reasonable and not excessive.shareholders:

Compensation PoliciesPractices

Employment Agreements: We have not entered into any employment agreements withThe committee leverages best practices in governing our named executive officers. All of our named executive officers are employed at will.

Change-in-Control Arrangements: In July 1999, we entered into a letter agreement with R. Stephen Armstrong, our Executive Vice President, Treasurer and Chief Financial Officer. Pursuant to the agreement, Mr. Armstrong is entitled to receive certain benefits upon a change-in-control termination. If (a) within the 210 calendar-day-period immediately following a change-in-control Mr. Armstrong’s employment is terminated for any reason other than death, cause, disability or retirement, (b) within such 210 calendar-day-period, Mr. Armstrong terminates his employment for good reason, or (c) prior to a change-in-control the termination of Mr. Armstrong’s employment was either a condition of the change-in-control or was at the request or insistence of a person (other than our company) related to the change-in-control, then we will make a lump-sum cash payment to Mr. Armstrong in an amount equal to the sum of (i) 12 times his monthly base compensation plus (ii) an amount equal to his target incentive under the then-existing management incentive plan at the 100% payout level. Further, on the first anniversary of the date of termination, we will make an additional lump-sum cash payment to Mr. Armstrong equal in amount to the aggregate initial lump-sum cash payment made under the letter agreement.

Our Amended and Restated Equity Incentive Plan provides that awards issued under that plan are fully vested and all restrictions on the awards lapse in the event of a change in control, as defined in such plan. Additionally, our Capital Accumulation Plan provides that on an event of acceleration, as defined in the plan, the restrictions on awards of restricted stock lapse and such stock becomes fully vested.

Impact of Tax and Accounting Treatment on Compensation Decisions: The Committee makes every reasonable effort to ensure that all compensation paid to our executives is fully deductible, provided it determines that application of applicable limits are consistent with our needs and executive compensation philosophy.programs. Therefore, there are certain things that we proudlydo and do not do:

| What We Do | What We Do Not Do |

Our income tax deduction for executive compensation is generally limited by Section 162(m) of the Code to $1 million per executive per year. This limit applies

■ Generally target executive compensation to be competitive at the median ■ Emphasize the majority of our program in variable pay ■ Use equity to drive a long-term perspective aligned with shareholders ■ Promote stock ownership with competitive stock ownership guidelines | ■ Provide change-in-control cash severance payments exceeding three times base salary and target annual incentives ■ Allow stock option repricing or discounted stock option granting ■ Offer change-in-control tax gross-ups to our Chief Executive Officer and the other named executive officers |

| What We Do | What We Do Not Do |

■ Include shareholder perspectives in our program plans and designs, including the incorporation of clawback and double trigger protections ■ Cap payouts in our annual short-term incentive awards (MICP) ■ Annually review our pay for performance relationship and conduct a compensation risk assessment | ■ Pay dividends or dividend equivalents on unearned or unvested performance shares ■ Allow our executives or directors to hedge or pledge company stock ■ Use employment or golden parachute agreements for executives, except in specific circumstances that provide a commensurate benefit to the company |

By incorporating the above practices, and avoiding problematic practices, the committee believes that we are in a strong position to accomplish our business strategy and compensation philosophy.

Compensation Components

To assist in understanding the intended goals of the committee, we have described, at a high level, each of our primary compensation elements in the following table:

| Element | Purpose | Key Features |

| Base Salary | ■ Provide a fixed level of compensation ■ Reflect competitive practices | ■ Salary levels set based on an assessment of: ● Level of responsibility ● Experience and time in position ● Individual performance ● Future potential ● Competitiveness ● Internal pay equity considerations ● Salary levels are reviewed annually

by the committee and adjusted as appropriate |

| Annual Management Incentive Compensation Plan (“MICP”) | ■ Provide formulaic incentives to achieve or exceed annual budgeted Adjusted Operating Income (“AOI”) and revenue growth ■ Include individual performance objectives for each executive ■ Link pay to performance | ■ Incentive payouts range from threshold to maximum levels, depending on level of performance ■ Performance below the threshold level will result in zero payout |

| Performance Units | ■ Provide executive officers with incentives to achieve long-term success | ■ Performance measure represents relative TSR versus the S&P 400

|

| Element | Purpose | Key Features |

| ■ Align executive officers’ interests with the interests of our shareholders | ■ TSR results at or above the 50th percentile are required for a target (or higher) payout ■ 3-year performance period |

| Stock Options | ■ Encourage sustained shareholder value creation via stock price increases | ■ 10-year term ■ 3-year vesting |

| Restricted Stock Units | ■ Provide opportunities for equity ownership ■ Encourage retention of executives | ■ 5-year ratable vesting criteria |

Base Salary

The committee annually reviews base salaries for the executive officers to determine an appropriate amount considering the factors identified in the Summary Compensation Table below. However, Section 162(m) also provides that qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. The Committee does not have a policy requiring aggregate compensation to meet the requirements for deductibility under Section 162(m).

Stock Ownership Guidelines: In March 2007, the Committee established stock ownership guidelines, which were approved by our Board of Directors, for our key executives and non-employee directors. We believe

that promoting share ownership aligns the interests of our key executives with those of our shareholders and provides strong motivation to build shareholder value. We plan to periodically review the stock ownership guidelines. Under our stock ownership guidelines, key executives are expected to own shares of a value equal to a multiple of their annual base pay as follows:

Chief Executive Officer – 5x

Subsidiary Presidents, Chief Financial Officer and Chief Information Officer – 3x

Corporate and Subsidiary Vice Presidents – 2x

Our guidelines also provide that non-employee directors are expected to own shares of a value equal to a multiple of five times their annual cash retainer.

Executives and directors are expected to achieve target levels over a period of five years. If an executive or director is below the guideline, he or she is expected to retain 75% of the net shares (after satisfying tax obligations) received upon exercise of a stock option or lapsing of restrictions on restricted stock. If the executive or director has met the minimum ownership guideline, he or she is expected to retain 25% of the net shares received. As of July 11, 2014, our executives and directors were in compliance with applicable stock ownership guidelines.

Role of Executive Officers: Messrs. Anderson and Armstrong attended several of the Committee’s meetings to provide certain recommendations to the Committee regarding the compensation of other executive officers and to discuss the financial implications of various compensatory awards and benefit programs. Messrs. Anderson and Armstrong were not present during the Committee’s discussion and determination of their respective compensation.

Components of Executive Officer Compensation

Our executive officer compensation is designed to reward both company performance and individual performance. Accountability, level of revenue and impact to the organization determine the total compensation value for a position. We believe that a substantial portion of an executive officer’s compensation should be at-risk. Toward that end, we keep base salaries below market medians, and have structured our incentive programs so that if our near and long-term goals are achieved, an executive could obtain total compensation at or above market medians for comparable positions. This practice is compatible with our compensation philosophy that links executive compensation to the attainment of business objectives and earnings performance, over the near and long term, which in turn enables us to attract, retain and reward executive officers who contribute to our success.

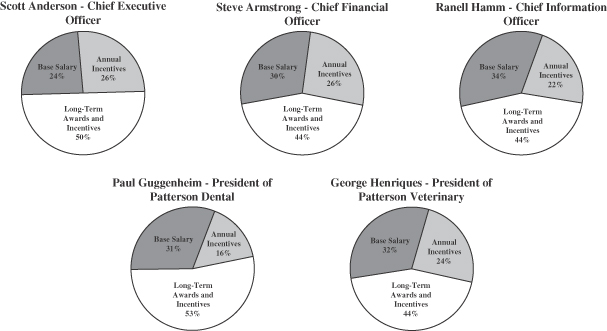

There are three core components of our executive officer compensation structure: base salary, annual incentives, and long-term awards and incentives. Our compensation philosophy is to target the base pay for our executives at approximately 85% of the market median and bring the executive compensation package at or above market with at-risk pay. Our at-risk pay includes annual incentives and long-term awards and incentives. Our executive officers also have an opportunity to purchase restricted stock under our Capital Accumulation Plan, which is described below. In addition, we provide our executive officers with certain perquisites and other personal benefits. Each individual component of executive compensation is discussed in detail below. The actual pay mix among base salary, annual incentives and long-term awards and incentives for our Chief Executive Officer and our other named executive officers for fiscal year 2014, which is described below, is depicted in the following pie charts:table.

MICP

Base Salary. Annual base salary levels for executive officers are determined by the potential impact of the individual on our company, the skills and experience required by the position, the individual performance of the executive, our overall performance and external pay practices. The Committee annually evaluates and determines the base salary for our executive officers. Our base salary ranges for fiscal year 2014 were consistent with our compensation philosophy.

Annual Incentives. Our named executive officers are eligible for anto earn annual cash incentive paid incompensation under the MICP. A cash throughincentive is payable if a threshold level of performance is achieved, and the Management Incentive Compensation Plan (“MICP”). The objective of the MICP is to encourage greater initiative, resourcefulness, teamwork and efficiency on the part of all key employees whose performance and responsibilities directly affect our profits. The overall goal of the MICP is to reward these officers for achieving superiorultimate payout varies with performance. These annual incentives provide a direct financial incentive to executives to achieve our annual profit goals.

The fiscal 2017 MICP was structured in a manner similar to that in place for fiscal 2016. The primary performance measures are reviewed and approved in advancemetric selected by the Committee eachcommittee was Adjusted Operating Income. The committee selected this measure for the following reasons:

| ■ | It is a well-understood financial measure that is communicated in Patterson’s Annual Report on Form 10-K |

| ■ | It is a balanced metric that encourages top line revenue growth, profit margins and cost containment |

| ■ | The committee believes that this financial measure influences Patterson’s stock price performance and its use effectively aligns the interests of executive officers and shareholders |

Similar to the prior fiscal year. Individual annualMICP, incentive targetspayouts are designed to vary according to performance outcomes as follows:

| | FY 2017 MICP Performance Goals: | |

| Level of Achievement | Adjusted Operating Income ($mils) | Payout

Potential |

| Total Company | Dental | Animal Health |

| Threshold | $396.3 | $244.8 | $68.9 | 25% |

| Target | $466.2 | $288.0 | $81.0 | 100% |

| Maximum | $536.1 | $331.2 | $93.2 | 175% |

| Actual Outcome | $381.3 | $222.1 | $48.9 | |

| % of Target | 82% | 77% | 60% | |

In addition to these financial performance objectives, the committee included individual strategic objectives for each named executive officer are approved byofficer. Objectives for this element considered items such as net sales, Next Generation System (SAP) implementation success, succession planning and team development and integration synergies. This individual element accounts for 15% of the Committee. The targets are positioned at or abovetarget annual incentive opportunity (for corporate officers the market median in order to achieve total direct cash compensation at market levels. The annual targeted bonus potentials for our named executive officers ranged from 75% to 125% of base salary in fiscal year 2014. The annual incentives in fiscal year 2014 for Messrs. Anderson and Armstrong and Ms. Hamm wereremaining 85% is based on our company’s actual income before taxes, LIFO provisionAdjusted Operating Income; for business unit leadership, the remaining 85% is split 15% corporate and incentive compensation (the “Company

70% business unit performance).MICP Income”) compared to budgeted Company MICP Income. The annual incentives in fiscal year 2014 for Messrs. Guggenheim and Henriques were based on the actual Company MICP Income compared to budgeted Company MICP Income (25%), and such officer’s individual business unit’s income after a net working asset charge and before taxes, LIFO provision and incentive compensation (the “Business Unit’s MICP Income”) compared to such officer’s budgeted Business Unit’s MICP Income (75%). The budgets are approved in advance by our Board. The targeted bonus potential pays out at 100% if budgeted performance is achieved. Each executive has the opportunity to increase his or her targeted bonus potential as a percentage of base salary by 3% for each 1% that actual performance exceeds budgeted performance up to 105% of budgeted performance, and by 6% for each 1% thereafter, subject to a cap at a 175% payout for actual performance equal to 115% of budgeted performance. Conversely, the MICP allowed 25%In consideration of the targeted bonus potential to be paid if 85% of the budgetedoverall performance was achieved. No bonus was to be paid if the actual performanceresults for fiscal year 2014 did2017, the minimum financial objectives were not achieve at least 85% of budgeted performance. For fiscal year 2014,met, and, in their discretion, the Company MICP Incomecommittee determined that no payments would be made to executive team members for individual performance target was $401,070,522. Subsequently, our Compensation Committee determined to adjustobjectives.

Long-Term Incentives

As noted earlier, the Company MICP Income performance target to exclude restructuring charges incurred during fiscal year 2014 due to the nature and determination of such charges relative to the setting of the annual targets for fiscal year 2014. Our company achieved 96% of that adjusted target. For Mr. Guggenheim, his individual budgeted Business Unit’s MICP Income performance target was $269,178,428 and his unit achieved 92% of that target. For Mr. Henriques, his individual budgeted Business Unit’s MICP Income performance target was $27,831,962 and his unit achieved 98% of that target; however, Mr. Henriques was paid an additional bonus of 2% of that target on a discretionary basis due to his exemplary efforts on our company’s U.K. Veterinary acquisition and integration.

The composition of the annual incentive plan performance targets for fiscal year 2015 is consistent with that established in fiscal year 2014, while budgeted Company MICP Income has been increased approximately 12% and budgeted Business Unit’s MICP Income for each unit has been increased approximately 7% to 21% over the levels achieved for fiscal year 2014. Individual performance can also be rewarded at the discretion of management and the Committee. For fiscal year 2015, the annual targeted bonus potentials for our named executive officers will range from 75% to 150% of base salary. The targeted bonus potential will pay out at 100% if budgeted performance is achieved. Each executive will have the opportunity to increase his or her targeted bonus potential as a percentage of base salary by 3% for each 1% that actual performance exceeds budgeted performance up to 105% of budgeted performance, and by 6% for each 1% thereafter, subject to a cap at a 175% payout for actual performance equal to 115% of budgeted performance.

Long-Term Awards and Incentives. Our Board has adopted a Long-Term Incentive Plan (“LTIP”) to address a need in our overall compensation package. The objectives of the LTIP are to: (1) create anlong-term incentive program to increase shareholder value over a longer term which does not compete with other benefit plans currently in place; (2) provide a program that assists in retention of and rewards new management employees by creating equity ownership in our company; and (3) recognize that equity compensation may not be appropriate for all management employees. Participants include officers, regional managers, branch managers and other key managers.

The LTIP originally provided for awards ofemphasizes performance via stock options and performance units, but also provides retention incentives via restricted stock units. The table below highlights the provisionvalue and number of life insurance. Stock options wereawards granted underto each named executive officer (a thorough description of each vehicle follows).

| Executive | | Performance Units

($ / #) | | | Stock

Options

($ / #) | | | Restricted

Stock Units

($ / #) | | | Total |

| | | | | | | | | | | | | | | | |

| Scott P. Anderson | | $ | 1,125,000

19,455 | | | $ | 562,500

68,681 | | | $ | 562,500

11,605 | | | $ | 2,250,000 |

| Ann B. Gugino | | $ | 325,000

5,620 | | | $ | 162,500

19,841 | | | $ | 162,500

3,353 | | | $ | 650,000 |

| John E. Adent | | $ | 275,000

4,756 | | | $ | 137,500

16,789 | | | $ | 137,500

2,837 | | | $ | 550,000 |

| Paul A. Guggenheim | | $ | 250,000

4,323 | | | | -

- | | | $ | 250,000

5,158 | | | $ | 500,000 |

| David G. Misiak | | $ | 162,500

2,999 | | | | -

- | | | $ | 162,500

3,432 | | | $ | 325,000 |

| Les B. Korsh | | $ | 170,000

2,940 | | | $ | 85,000

10,379 | | | $ | 85,000

1,754 | | | $ | 340,000 |

* Note: the employee stock option plans adoptedvalues in 1992 and 2002, andthis table may not exactly equal the life insurance was a split dollar policy owned bySummary Compensation Table due to rounding.

Performance Units

Effective in fiscal 2016, the individual but funded by our company. The premiums on each such life insurance policy paid by our company created a lien againstcommittee redesigned the policy and were repayable on the earlierperformance unit element of the policy owner’s 65th birthday or 15 years fromexecutive compensation program to emphasize shareholder value creation in a direct way. The committee decided to reference relative TSR versus the initiation ofS&P 400 as its performance measure rather than internal financial objectives, which the policy. Stock options vested incrementally over a three-to-nine year periodcompany had used previously. The program has the following pay for performance relationship, and the life insurance created an immediate death benefit while providing long-term cash value over fiveother features:

Patterson Relative TSR Pay for Performance Relationship

| | Additional Performance Features: ■ If absolute TSR is negative, then the payout is capped at the target level ■ The performance units do not have rights to regular dividends during the performance period |

Similar to 15 years as a supplemental source of retirement income. We ceased paying the premiumsfiscal 2016, for the split dollar life insurance policies under the LTIP in fiscal year 2004 in order to comply with the provisions of the Sarbanes-Oxley Act. Our Chief Financial Officer opted to maintain his split dollar life insurance policy with premium payments in lieu of certain equity awards in fiscal years 2006 through 2014. The premium payments are treated as cash compensation and current taxable income. We discontinued awarding stock options to U.S. participants under the LTIP in fiscal year 2006, but resumed again for certain executives in fiscal year 2015, as described below.

As to any award not intended to constitute “performance-based compensation” under Section 162(m) of the Code, the LTIP permits us to accelerate the vesting of options and the lapsing of restrictions on restricted stock awards upon an executive’s termination of employment following attainment of age 65 with at least ten years of service.

Beginning in fiscal year 2005, the Committee revised the LTIP to provide awards of restricted stock and performance units under the Equity Incentive Plan. The restricted stock and performance unit ranges are set to provide flexibility in structuring individually appropriate compensation and to create a market competitive component of the overall compensation package for each executive. Annually, the Committee determines a level of compensation under the LTIP for each executive position. Through fiscal year 2014, the approved award level was weighted 75% to restricted stock and 25% to performance units and, except for promotions or new hires that occur during the fiscal year, the numbers of units of these equity components were determined on the first daygranted as part of the fiscal year based upon the closing price2017 compensation program, TSR of our company’s common stock on such date.

For fiscal year 2015, the approved award level for the CEO and three business unit Presidents is weighted 25% to restricted stock, 50% to performance units and 25% to stock options and, for the remaining executives, is weighted 50% to restricted stock and 50% to performance units. Our Committee reinstituted the award of stock options to certain executives in fiscal year 2015 to reflect current trends in equity compensation practices, to cause a greater percentage of non-cash compensation to be performance-based, and to facilitate retention through use of a longer term to full vesting. As to all of our executives, the reduced percentage of restricted stock granted in fiscal year 2015 was intended to increase the percentage of equity-based compensation that is performance-based. The numbers of units of these equity components were determined on July 1, 2014 based upon the closing price of our company’s common stock on that date.

In general, the restricted stock awards vest 20% each year beginning on the first anniversary of the date of grant,Patterson and the performance units vest on the third anniversary of the award. Prior to fiscal 2012, the restricted stock awards vested 20% each year beginning on the third anniversary of the date of the grant. Upon achievement of pre-determined performance objectives, the outstanding performance units mayS&P 400 will be settled in cash or stock, at the discretion of the Committee. The stock option awards vest three years from the date of award and expire ten years from the date of award.

The right to receive the value of the performance units is conditioned upon achieving, during a three-year period, the financial targets established by the Committee at the beginning of the period. In particular, the total value of the award is equivalent to the number of units multiplied by the unit value, which for the awards to date has been the closing price of our company’s common stock on the first day of the fiscal year. For participants to earn 100% of the award, the performance targets must be achieved. The targets, which are established at time of grant, for the awards granted under this program through and including fiscal year 2013, require achieving a specified operating margin in the third year of the performance period and achieving a specified average return on equity for the three-year period. The performance targets for the awards granted under this program in each of fiscal years 2014 and 2015 require achieving specified average operating income growth and average return on invested capital over a three-year period. No units are earned if a specified minimum average operating margin for the relevant three-year period and a specified minimum average return on equity for the relevant three-year period are not achieved. If the minimum performance targets are not met, all units are cancelled. For performance units awarded in fiscal years 2014 and 2015, the number of units an award recipient can earn for performance above the targeted performance is a maximum of 150% of the units awarded. The minimum and maximum ranges are determined by subtracting or adding 20 basis points to the performance targets for the specific award period.

The financial targets for performance units awarded in fiscal years 2006 through 2009 were not achieved and, consequently, such awards have been cancelled. In fiscal years 2010 and 2011, the Committee determined that it could better achieve its objectives of incentivizing and retaining our named executive officers by increasing the restricted stock awards made to such officers and not granting performance units. Such